34+ mortgage approval based on income

Ad Calculate Your Payment with 0 Down. Web Step 1.

Glenn E Grant Mortgage Loan Officer Maxwell Mortgage Team Linkedin

Connect with a reverse mortgage lender now to see if you qualify with a free consultation.

. Apply Online Get Pre-Approved Today. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web Based on your income expenses and the loan you selected the amount above represents the most you can comfortably afford to pay for a home.

Get All The Info You Need To Choose a Mortgage Loan. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Apply Online To Enjoy A Service.

Web But as a rule of thumb its often possible to buy a house with low income if you meet these requirements. This step is optional but it gives you an idea of how much home you can afford along with potential rates. This assumes that your total.

This means your monthly payments should be no more than 31 of your. Save Real Money Today. Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best.

You can find the. Choose The Loan That Suits You. Web With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability.

Highest Satisfaction for Mortgage Origination. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad Compare Best Mortgage Lenders 2023. Find A Lender That Offers Great Service. Web The United States Department of Agriculture USDA runs a loan program that offers mortgages to low- to moderate-income households in rural areas.

It can also give you a. Web The 5 mortgage scheme - also known as the Mortgage Guarantee Scheme - is a new government-backed scheme allowing first time buyers home movers and previous. Web MyHome Assistance Program.

See How Much You Can Save with Low Money Down. Find A Lender That Offers Great Service. Stable two-year job history Steady reliable income Credit.

Web A CalHFA approved Lender will qualify you for a home loan so you will need to apply with one of our Preferred Loan Officers or approved Lenders See Step 2. CalHFA assists low and moderate-income homebuyers in the realization of their goal of homeownership in California. Ad Compare More Than Just Rates.

Web This Mortgage Pre-Approval Calculator helps you estimate your pre-approval amount based on your income and financial situation. Web The LIPA program helps first-time low-income homebuyers purchase homes in the City of Los Angeles by providing loans to cover the down payment closing. The MyHome Assistance Program provides up to 35 of a homes purchase price or appraised value whichever is lower to help.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Conventional mortgage approval. Ad Compare More Than Just Rates.

Web Income Limits for CalHFA Home Buying. Web A 300000 house with a 5 interest rate for 30 years and 15000 5 down will require an annual income of 77087. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Fannie Mae and Freddie Mac Freddie Mac and Fannie Mae loans also called conforming mortgages allow FICO scores as low as. Web Getting a mortgage for self-employed borrowers could be more challenging during the COVID-19 downturn as lenders take extra steps to verify income. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. This calculation is for an individual with no. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it.

Web How Much Mortgage Can I Afford Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two.

1785 Pine Rd Cleveland Tx 77328 For Sale Mls 81473530 Re Max

What Sources Of Income Count Toward Mortgage Qualification

What Sources Of Income Count Toward Mortgage Qualification

Questions A Lender Will Ask

What Sources Of Income Count Toward Mortgage Qualification

The Difference Between Pre Qualification And Pre Approval Carol Flanagan Guild Mortgage Llc

3 Big Reasons A Mortgage Prequalification Isn T Enough To Buy A Home

Mortgage Statement 10 Examples Format Pdf Examples

How To Get A Mortgage When You Re Self Employed

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

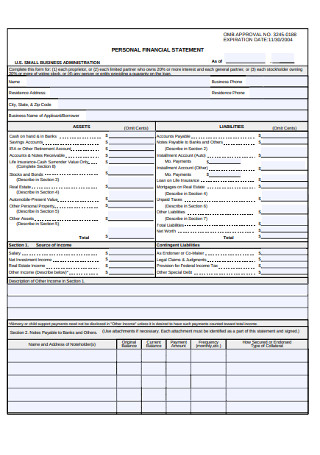

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

Mortgage Affordability How Much Can You Afford

Eu Council Manual Law Enforcement Information Exchange 7779 15

What Sources Of Income Count Toward Mortgage Qualification

Mortgage Preapproval Vs Prequalification How To Get Preapproved

Our Mobile Mortgage Brokers Bunbury Busselton Mortgage Choice

Income Requirements For A Mortgage 2023 Income Guidelines